Context

Time for insurance

Over the last thirty years, the European Watch Company has become the world’s premier watch retailer through their steadfast commitment to doing what is right for their customers.

When their customers started asking about insuring their watch collections, EWC wanted to deliver an exceptional insurance experience for them.

They partnered with Chubb to become the first pilot user of Chubb’s new API. With all the pieces in place, they just needed to bring everything to life. That’s where we stepped in.

Challenges

Not a minute to waste

We started the project the first week of October and Chubb had a hard deadline to launch their first API pilot into the market by the end of the year.

To ensure we could meet this deadline, we sat down with everyone to define our go-to-market requirements. The challenge here was aligning all the parties around clear, achievable feature sets that satisfied their top priorities while laying out a roadmap of future milestones we could build towards after launch.

Complicating things even further, Chubb’s API was still under active development. Consequently, there was little to no documentation in place and all of the endpoints, requests, and responses were fluidly evolving as we tried to build. So, we spent many sessions collaborating with their technical team to map out expected behaviors and planning for future changes.

Approach

On your marks, get set, build!

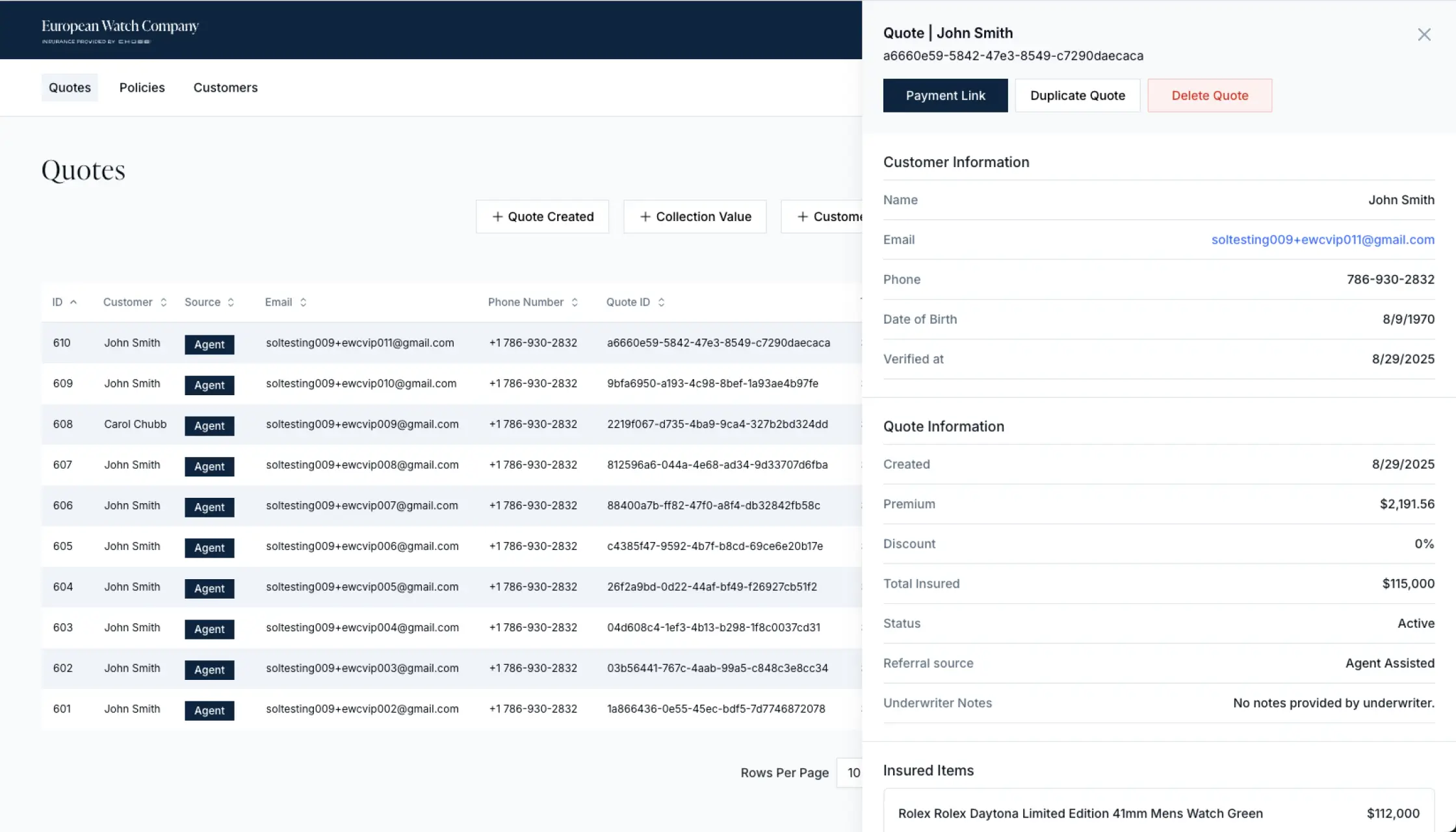

With our requirements in hand, we began designing while simultaneously prototyping with Chubb’s API. After several iterations, we had designed a broker portal tailored to EWC’s internal workflows. Giving their team an intuitive, centralized hub to manage customer quotes and policies with precision.

Behind the scenes, we integrated directly with Chubb’s partner API to support real-time quote generation and policy binding, ensuring that EWC could serve clients instantly and accurately.

By the end of November, the first iteration of the platform was deployed and ready for testing.

Results

With $600k and counting in premiums, it’s champagne time

By launch, EWC had delivered a seamless digital insurance experience that exceeded expectations on every front—launching on time, earning praise from Chubb’s internal teams, and going on to generate over $600,000 in premium within its first eight months of use.

The platform positions EWC as a category leader in tech-enabled luxury brokerage, setting a new benchmark for how tradition and innovation can coexist in the insurance space, and enabling them to continue doing right by their customers.

Contact us

Book an intro call

A quick, 30-minute introduction–we'll get to know each other and start identifying your biggest process & technology bottlenecks. No hard sells, just insights.

Just want to get in touch? Drop us a line at: hello@markhamsq.com